Nevis- Companies, Trusts & Foundations

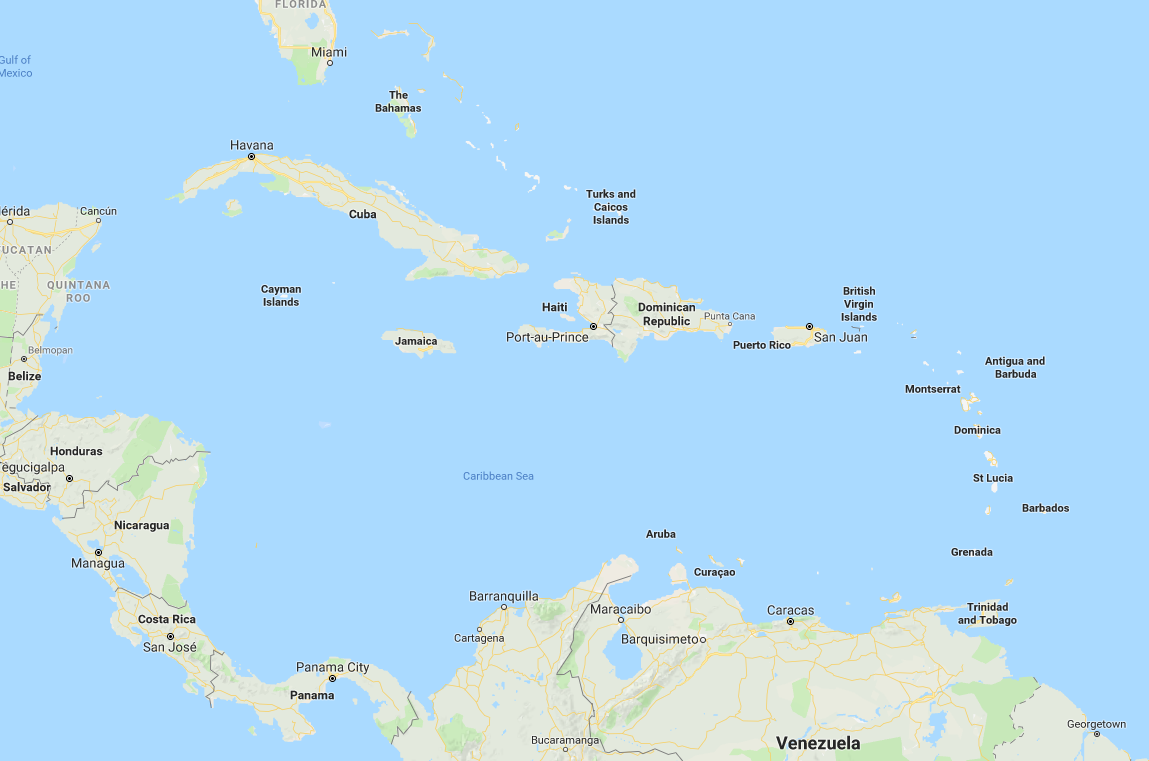

Nevis is located at the tip of the Lesser Antilles archipelago in the Caribbean, about 200 miles south of Puerto Rico and west of Antigua. The island was discovered by Christopher Columbus on his second voyage in 1493 and was a British colony from 1628 until 1983, when it became independent and joined the Federation of St. Kitts and Nevis. The population of Nevis amounts to about 11,000, the official language is English and the literacy rate is 96%.

Nevis has long been considered an ideal environment for offshore companies, foundations and international trusts. The island does not levy any taxes for income earned outside of Nevis, privacy is fully protected, while all company assets are effectively shielded based on several layers of legislation.

There are 2 forms of international business formations in Nevis: International Business Corporation (IBC) and Limited Liability Company (LLC). Both the Nevis LLC and the Nevis IBC offer distinct tax advantages, easy registration, competitive fees and excellent protection of your assets against any third-party lawsuits.

Limited Liability Company (LLC)

The Nevis LLC is a good option for those considering an operating business or partnership. A Nevis LLC is a legal entity with separate rights and obligations from its managers or members. Most business owners choose to form a Nevis LLC primarily because having a Nevis LLC protects their business and assets, as third-party lawsuits in Nevis have virtually no chance of success.

Nevis LLCs are exempt from national tax on income, profits, dividends, interest and capital gains if earned outside the borders of St. Kitts and Nevis. The LLC’s profits must be taxed according to the member’s / manager’s tax residence. So, from a tax perspective, forming a Nevis LLC has advantages if you are a resident of a low tax jurisdiction, or a resident in a country with extra-territorial tax or if you are not a resident anywhere (PT / Digital Nomad).

Another important reason people choose a Nevis LLC is for maximum privacy. There are no public records about the company, its members or beneficial ownership, i.e. names and other information of members are not filed in the public record (Company Register). Additionally, a Nevis LLC is allowed to appoint a Nominee Member or Nominee Manager.

A LLC formed in Nevis may be used, with a few exceptions, for any lawful business purpose, including real estate ownership, manufacturing operations, a consulting business or as an investment vehicle for international trusts. Each Nevis LLC is required to maintain a registered agent in Nevis. When forming a Nevis LLC, no initial capital is required and the LLC is not required to issue membership shares to begin operations.

Foreign LLCs or IBCs, or even corporations, can move their registered office to Nevis very efficiently within a few days.

Advantages in Nevis

Nevis Business Corporation (NBCO)

A Nevis Business Corporation (NBCO) is suitable for larger companies. You can already tell from the possible suffixes for the company name. Founders may choose between e.g. S.A., Corporation, Inc. or even A.G. or GmbH (Swiss / German types of company).

In a NBCO (also known as IBC) the founder may appoint shareholders, officers and directors. They can be of any nationality and may reside anywhere. As with an LLC, income and profits earned outside of Nevis are tax free in Nevis. The NBCO is suitable to serve as a trustee to a Nevis trust, where a local trustee is required.

While corporate and accounting records must be readily available to the Corporation’s registered agent and to the Financial Services of Nevis upon request, they do not have to be organized in any particular system and don’t have to be filed.

NBCOs may amend their certificate of incorporation, merge or consolidate with foreign corporations or other Nevis corporations.

Nevis Trusts

A Nevis International Exempt Trust offers, especially in combination with a Nevis LLC, a formidable form of asset protection. It may serve, similar to Nevis Multiform Foundations, several different purposes. Trusts can be set up as a Charitable Trust, a Non-Charitable Trust or Spendthrift / Protective Trust. A Nevis Trust is required to have a local trustee, which either may be a local trust company, a local LLC / IBC or a Nevis Foundation. Forced heirship rules from foreign countries are not recognized in Nevis, neither are foreign judgements. For further information and application details, please get in contact with me.

Multiform Foundations

Each Nevis foundation has a declared so-called form. This means that the foundation’s articles of incorporation specify how it is to be treated, whether as an Ordinary Foundation, a Trust Foundation, a Company Foundation or a Partnership Foundation

A Nevis foundation is usually established as an ordinary foundation. The multiform concept allows the stated identity of the foundation to be changed during its life, allowing greater flexibility in its use and application.

Generally, a Nevis foundation can be used for estate planning, charitable purposes, wealth management, and special investment holding arrangements. Nevis legislation provides that corporations may be converted or re-organized, continued or consolidated, and merged into a Nevis multiform foundation.

There is no tax liability for the multiform foundation or its beneficiaries on income or gains earned outside of Nevis. However, it is possible for a Nevis foundation to apply for tax residency in Nevis – it then becomes a tax resident foundation. The tax is 1%. It is also interesting to note that foreign laws on legal succession (Forced Heirship) are not recognized in Nevis.

Get Started

If you are interested in setting up your company, trust or foundation in Nevis, please get in touch with me.